Advertised credit claims are typical results for customers who use Extra as recommended and are based on a study using data from Experian. To learn more, visit extra.app/study

- No interest or hidden fees—ever

- Earn rewards with every swipe1

- Use your own bank account2

Build credit with debit

- Keep your current bank2

- Earn reward points1

- No credit check, no hidden fees, and no interest rates, ever.

Good things come to those who are Extra

Members increased their credit score by an average of 48 points by regularly swiping with Extra and practicing good credit habits.3

Pull up. Swipe up. Glow up.

Most Extra cardholders are able to open 1-4 new credit cards in their first year of membership.3

Future you will be living the dream

Extra members were 2x more likely to open an auto loan and 3x more likely to open a mortgage than non-Extra members.3

Credit confidence thanks to a debit card.

Extra members who use the product as recommended were more likely to achieve and maintain good credit scores than consumers who demonstrated healthy credit behaviors alone.3

Our Plans

Credit Building

Credit Building + Rewards

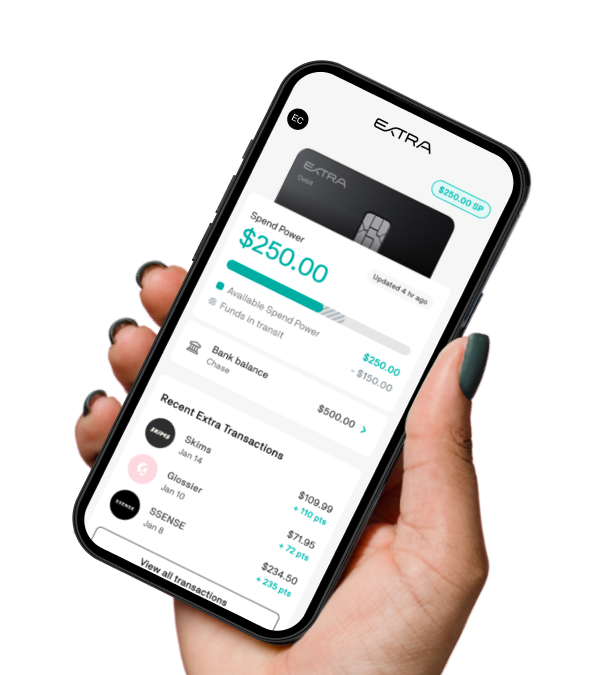

Debit that builds credit

Extra spend tracking app

Best-looking debit card ever

Earn reward points for every purchase

Credit Building

Credit Building + Rewards

Debit that builds credit

Extra spend tracking app

Best-looking debit card ever

Earn reward points for every purchase

Credit Building

Credit Building + Rewards

Debit that builds credit

Extra spend tracking app

Best-looking debit card ever

Earn reward points for every purchase

Credit Building

Credit Building + Rewards

Debit that builds credit

Extra spend tracking app

Best-looking debit card ever

Earn reward points for every purchase